what do you earn for delegating grt to an indexer – For every 11,000 GRT outsourced to indexers, who get a 15% cut, you can only anticipate receiving approximately 7-8 GRT in incentives. Delegators are system participants who provide one or more indexers with a GRT share.

Despite needing to manage a graph node, delegators contribute to network security. Delegators receive a share of the benefits and inquiry fees paid to the indexer by the indexer.

Fees

Operating a Graph Node allows you to contribute to the safety and reliability of the network, but giving your GRT to an indexer allows you to partake in the charge or incentive that the indexer receives. An indexer may handle more requests the more GRT you invest in it. Based on how much each inquiry costs, the stakes are determined. Read our GRT delegation guide for more information.

You give an indexer the right to select the person(s) who will index your GRT when you delegate GRT to someone. Indexers must be trustworthy and competent to avoid outsourcing your GRT and jeopardizing your award. Due to the Cobb-Douglas method for compensation, indexers split their earnings with their indexers. The delegation’s networking functions cost this amount. For assigning their GRT to an indexer, the delegate will get a payment of 0.5%.

The protocol determines how much it costs to assign GRT to an indexer. The rebate pool will receive a fee from each operation, which will then be divided following the shareholding and Cobb-Douglas real output. If indexers produce more worthwhile work than those other indexers, they will be paid more incentives. As a result, the GRT that the indexer has risked determines how much the indexer is paid.

A portion of the benefit from delegating GRT goes to the indexer. It can vary greatly, and depending on how successfully the indexing assignment is completed, the indexer will have a lower or greater APR. Earnings for indexers range from 7% to 15% of the total GRT indexed. Since just a tiny portion of the rewards are accrued at the indexer’s address, indexers will incur fewer costs than those associated with assigning GRT to an indexer.

Read More- Most Profitable Cryptocurrency To Invest In 2022

Increasing benefits

Tokens given to an indexer may affect the system in various ways. For starters, it may result in several GRT token distributions, erroneously increasing the overall amount of tokens distributed. As an outcome, delegators can receive larger tokens than their overall investment. Additionally, their assets continue to be allocated for four weeks after delegating.

A set of conditions creates inflationary incentives. The GRT that the indexer invests in the system is rewarded with a portion of the total charges for each inquiry. Misconduct might result in many indexers losing their tokens. In particular, the curatorial signal determines how many individuals characterized by abnormalities receive the indexer’s share of the networking token. New paragraphs can be bootstrapped using this version.

When indexers entrust them, they receive a higher share of the bonuses. For instance, an indexer with 99 GRT can eventually gain up to 1 million GRT because indexers can only be delegated to 16 people at once. The indexer won’t get any benefits based on extra capacity, though, if there are any. Additionally, the extra TSOs will lessen the delegator’s benefits.

The cut rate isn’t a reliable predictor of indexers’ prospective earnings. This is so that indexers can receive a service charge dependent on both the ownership proportion of the statesperson and their compensation charge. But it’s important to remember that burned rebates make indexers and delegators less profitable. As a result, indexers must modify their cut rate to ensure that the staking money is distributed fairly.

Read More- The Most Outstanding Wins in Slots History

Query costs

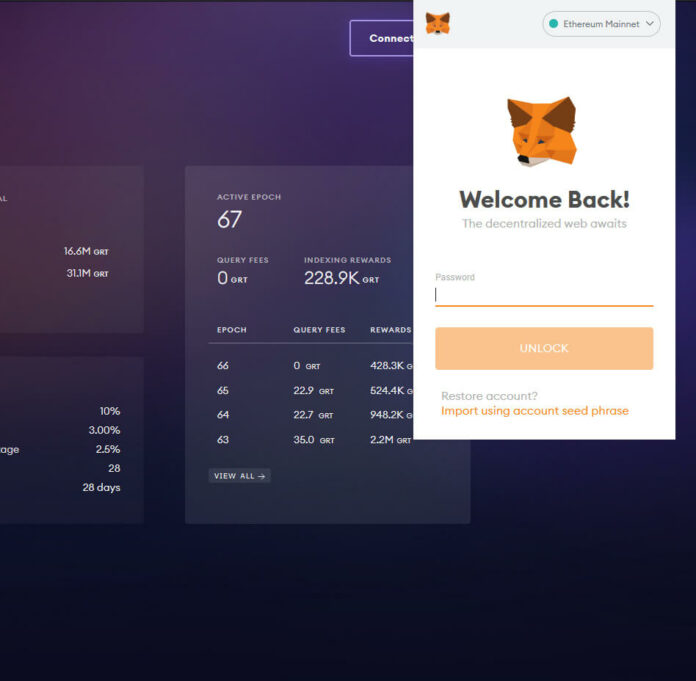

Outsource your GRT unit to an indexer using a Metamask or WalletConnect account. Tap on that Indexer Fee Reduction tab and remain aware of how much compensation the indexer retains from each query if you wish to receive a return. This data is located in the Indexer Charge Cut menu bar at the bottom. To transfer your GRT currency to indexers instead, sign up for the Ethereum platform.

The primary and most crucial guideline is to hand-pick the indexer. A delegated indexer should wait four weeks after the refrigerating period has passed before redelegating tokens.

Your assets will be burned if you redelegate them to an indexer who performs poorly since they won’t be capable of receiving incentives. Ensure the indexer you select has a solid track record and performance review. You will forfeit your delegation of authority fee and the benefits you will earn if you don’t.

Different query fees are charged for assigning GRT to indexers. Each indexer has a stake in GRT, and the number of delegated tokens affects the incentive pool. This offers customers a sense of the queries’ financial stability. This also assists indexers in developing credibility among clients, which benefits both parties. Furthermore, outsourcing GRT to an indexer enables inactive token holders to contribute minimal risk.

The GRT coin is a coin indexers receive from inquiries, while controllers get paid for metering. This statistic contributes to the show’s financial openness and permits indexers to receive GRT tokens in return for their efforts. As an outcome, these indexers are important to the platform’s general stability. Users will be required to charge for index services if the technique is not accessible.

Read More- Reddit fueled penny rally in Sydney

Uncoupling phase

Tokens about mostly helpful indexers could be exchanged or generated for 27 days following the requisite 27-day unbinding period, which is required when assigning GRT to an indexer. The delegator must select an indexer who is deserving of his confidence throughout this period. A poor indexer will lose the delegator’s delegation fee, but a competent indexer will continue to receive the incentive for 27 days.

Narrowing the unbinding period for assigning GRT to an indexer has several benefits and drawbacks. The marketplace will have more stability during the unbinding phase, giving delegators more time to reply to indexers’ demands and spending less on gas. Nevertheless, as indexers will need to terminate assignments more often than just about every other four weeks, it may also make delegation less profitable.

The fact that indexers are unaware of their prospective earnings represents one of this design’s main downsides. They cannot modify the cut rate to guarantee a fair distribution of money at risk since they are unsure of the size of their entire stake. The proportion of the delegator’s interest to the indexer’s stake also affects the cut-rate. This represents a design problem, and Hallucination wants to fix it immediately.

What Do You Earn For Delegating GRT to an Indexer? I hope I answered it very elaborately, along with various aspects.

Read More-Are you paying extra Tax than needed? Here’s how you can refund!